The build-to-rent (BTR) industry has been the fastest-growing segment of single-family home construction for a number of years. With mortgage rates now exceeding 6.5%, a limited supply of homes, and sustained high demand, new homebuyers would require a six-figure income to afford a median-priced house, according to a recent Bankrate study.

"In 90% of our major cities, renting is less expensive than buying a home," says Richard Ross, CEO of Quinn Residences in Georgia. "In 2020, renting was about 20% cheaper than buying," he says. "This year, it's about 60% cheaper."

Build-to-rent homes and communities allow those who want the suburban, single-family home lifestyle but have limited funds to secure a mortgage. These planned communities often include shared amenities like pool and park areas. The only difference between it and another community is that the homes are designed to be rented instead of purchased.

For this report, we asked top experts in the home construction industry for their insights on BTR in 2024, why the demand continues to grow, and what to expect moving forward.

Key Findings:

-

Fixr.com estimates that the total number of BTR home starts nationwide in 2023 is 112,920; a 102% increase since 2019.

-

According to 71% of experts, home affordability is the main reason behind the demand for BTR homes.

-

55% of experts say Millennials drive the demand for BTR homes, closely followed by 48% attributing it to Gen Z.

Build-to-Rent Home Construction Rate Is Higher Than You Think

According to an analysis of U.S. Census data, the National Association of Home Builders (NAHB) reports 75,000 BTR starts in 2023. However, this doesn’t account for the approximate 4% sold for renting purposes. Fixr.com predicts the 4% adds another 37,920 units, resulting in 112,920 BTR home starts nationwide–an increase of 102.5% from 2019 but a 5% decrease from 2022.

This decline marks the first in five years and may be due to more difficult financing. "While various forms of financing seem available, terms are typically more stringent, with lower leverage and higher rates, than prior to recent inflationary conditions," says Darin Rowe, President of Yardly For-Rent Brand at Taylor Morrison.

Home Affordability Is the Key Driver of Build-to-Rent Sector Growth

"In percentage terms, BTR is the fastest growing sector with a long runway ahead," Rowe says. To find out why, we surveyed home construction experts across the United States about the factors contributing to the growth of BTR, and their responses are above.

According to 71% of those experts, home affordability is the main reason for the increase in BTR homes. This conclusion makes sense when you consider that 76.9% of U.S. households cannot afford a median-price home of $495,750 at 6.5% interest.

To complicate matters, Harvard University's Joint Center for Housing Studies reports that even though renting is cheaper than buying in the U.S., about a quarter of cost-burdened renters (around 12 million households) spend more than 50% of their income on housing. This ratio is much higher than the recommended 30% by the National Foundation for Credit Counseling.

According to 36% of survey respondents, real estate investment is the second reason for the increase in BTR homes. John Isakson, CEO of ARK Homes For Rent, based in Miami, believes this is because the BTR industry allows builders to keep building. "Builders who sold solely to buyers five years ago now have the option to sell to property management companies. This creates a wider market for builders to sell."

Millennials and Gen Z Are Driving the Build-to-Rent Boom

Currently, 55% of the experts we interviewed say Millennials drive the demand in BTR housing, with Gen Z following closely at 47.5%. Besides the fact that fewer households can afford to buy a home, the reasons behind the growth of the BTR industry are multi-faceted.

"There's flexibility in renting," says Ross. "Some people are renters by choice. They don't want to be tied down," he says. He refers to this group as DINKs–Double Income, No Kids. Ross' thoughts correlate with the rise of digital nomadism. According to the MBO Partners 2023 State of Independence report, digital nomadism has become mainstream. They report that 17.3 million Americans who work describe themselves as digital nomads. This number is a staggering 137% increase since 2019. Also, 58% of digital nomads are from the Gen Z (21%) or millennial (37%) generations.

Top 20 Metros for Build-to-Rent Completions

According to Isakson, areas of high population growth and migration account for a large part of the growth in the build-to-rent market. "We see the highest growth in the Smile States," he says.

RentCafe's analysis of the build-to-rent, single-family (BTRSF) housing boom supports that opinion. A few markets stand out in its analysis. Here's what we see:

-

Phoenix, Arizona, led the build-to-rent market in 2023 with 4,030 completions, representing 43.12% of its 5-year total from 2019 to 2023.

-

Dallas, Texas, and Atlanta, Georgia, followed with 2,694 and 1,981 completions, respectively. Atlanta's 2023 completions represent more than half of its 5-year total.

-

Other notable metros include Myrtle Beach, South Carolina, and Pensacola, Florida, where completions accounted for 65.69% and 70.14% of their respective five-year totals.

-

Orlando, Florida, achieved 100% of its total five-year completions in 2023 alone, highlighting a significant surge in the BTR sector.

The Future of the Build-to-Rent Market

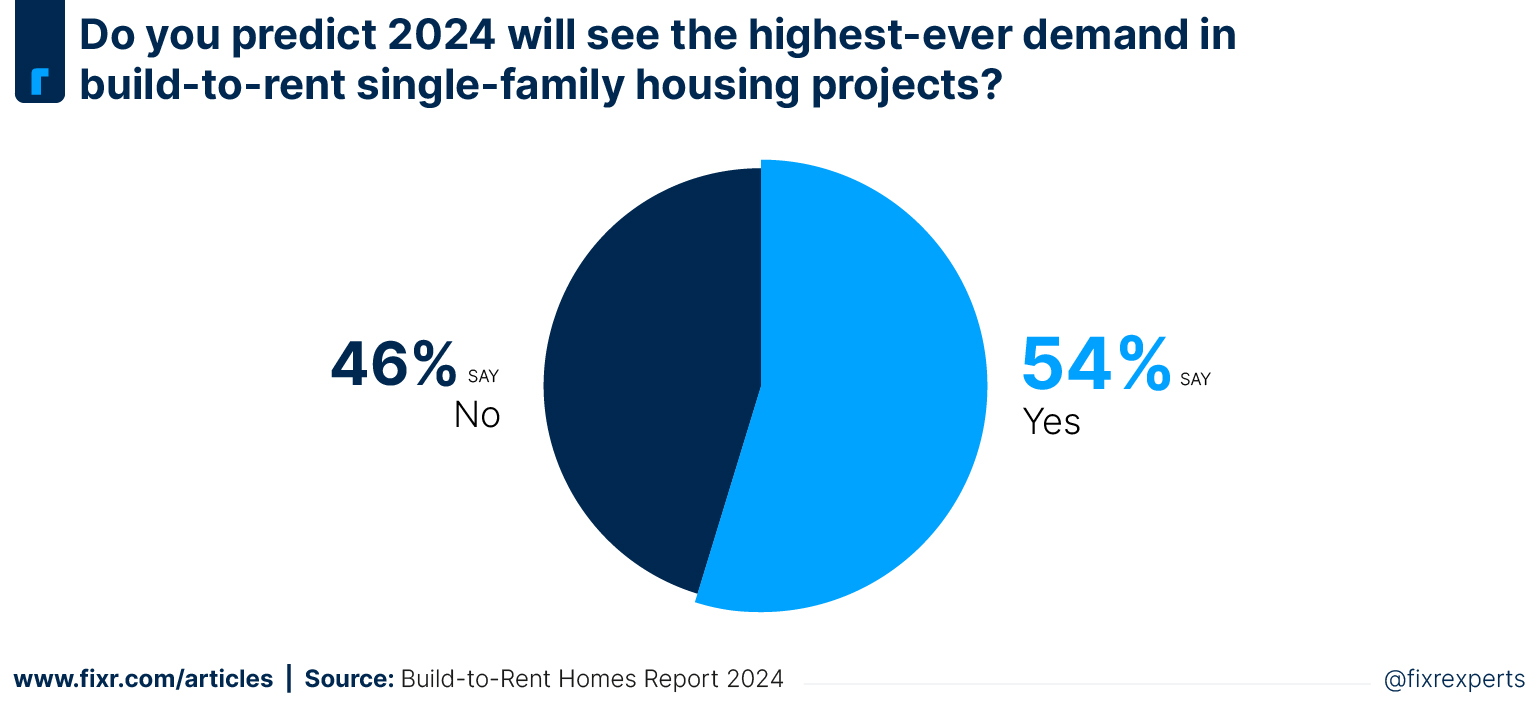

The outlook for the BTR market in 2024 is mixed, reflecting uncertainty among experts. When asked if 2024 will see the highest-ever demand in BTRSF housing projects, 54% of experts said yes, while 46% said no. What could this nearly even split mean?

According to Robert Dietz, NAHB's Senior Vice President and Chief Economist, "Higher interest rates have reduced some investor demand for single-family build-for-rent homes."

But Isakson says the near-even split could indicate that builders have different opinions on what interest rates will do. "If the interest rates go down," he says, "more people will buy homes, which will cause the BTR industry to slow down. But if the interest rates remain stable or increase, the BTR industry will continue to grow."

Whatever happens to interest rates and the availability of investor funds, experts do agree that the BTR market will evolve in various ways over the next few years. When asked how they anticipate the market evolving, they highlighted several key trends:

Continued rising demand for build-to-rent properties

According to 43% of the experts surveyed, the household demand for BTR will continue to rise. In addition to flexibility, Ross says maintenance-free living is another factor driving the demand for BTRSF homes. Young professionals want to use their free time to pursue hobbies and spend time with family, not mow the lawn or unclog the drain. In a BTR community, the property management association takes care of all that.

Other benefits to BTR communities include spacious homes and pet-friendly environments. And including more tech is a draw for the younger generations. "Because the homes are brand new," says Ross, "we can outfit them with the latest technology." He says Quinn Residence equips their homes with leak detectors on appliances like dishwashers, washing machines, and water heaters. Third-party security monitoring with direct access to law enforcement is another benefit.

Higher demand for community living and shared amenities

Of the experts Fixr.com surveyed, 43% say they noticed a higher demand for community living. Shared amenities like pool and recreation areas become locations for neighbors to meet and build relationships. This sense of community is essential for families with children and older, active adults.

And in urban areas with steep rental prices, co-living spaces are emerging. Co-living is similar to co-working, where tenants have a designated desk but share common areas like conference rooms. In a co-living situation, however, everyone has a private bedroom with shared bathrooms, a kitchen, and a recreation room. Though this BTR model is budget-friendly, Dietz says he's "never seen good data on co-living."

However, Ross reports an increase in accessory dwelling units (ADU) to accommodate extended family members or friends. From the outside, an ADU resembles a backyard shed. But inside, it's completely weather-proofed and outfitted as a living space. It serves as an additional bedroom and possibly a bathroom, and the tenant shares the common areas in the home.

"We're in a housing crisis in this country, and we need creative ways to solve that," says Ross. However, whether co-living will continue to grow as an option remains to be seen.

Growth of specialized build-to-rent sectors

Specialized sectors of the BTR industry cater to specific demographics by offering tailored amenities for each group. For example, housing for aging adults may include healthcare facilities and accessibility features. And student accommodations may consist of study areas, communal spaces, and recreational facilities. Of the experts surveyed, 36% think the build-to-rent market will grow in these areas.

Supply falling short of demand

Some experts are concerned that the supply of build-to-rent housing will not keep up with demand. Isakson believes the industry can keep up. "Inflation is the biggest enemy," he says. “The growth is healthy, and it's filling an increasing need." So, as long as the costs can support keeping rents stable, he sees the BTR industry as a "great way to stem concerns about the housing shortage."

Build-to-Rent Is Built to Stay

As we've seen, the build-to-rent industry meets this country's need for housing options. And its growth is based on more than financial reasons. We see young professionals who want the lifestyle afforded by homeownership without the responsibilities. "They don't see a home as the asset their parents did," says Isakson. "They don't have the same attachment to using it as a piggy bank."

Ross puts it another way. "The American Dream is morphing," he says. And it's not centered around homeownership.

Carol J Alexander is a home remodeling industry expert for Fixr.com. For more than 15 years as a journalist and content marketer, her in-depth research, interviewing skills, and technical insight have ensured she provides the most accurate and current information on a given topic. Before joining the Fixr team, her personal clients included leaders in the building materials market like Behr Paint Company, CertainTeed, and Chicago Faucet, and national publications like This Old House and Real Homes.