Demand for workers is surging in 2025, with construction firms seeking additional workers to meet upcoming projects in housing, infrastructure, and energy. Yet, the construction labor force faces steep challenges: an aging workforce, decades of underinvestment in vocational training, immigration-related labor constraints, and persistent stigma around construction trades careers. At the same time, construction technology is reshaping the industry, improving efficiency and coordination, but not replacing hands-on skilled labor.

To better understand the workforce dynamics, we spoke with industry experts and analyzed nationwide data on job openings, wages, and labor market trends across states.

Industry Experts Interviewed:

Aaron Shavel, Civil Engineer, Infrastructure Consultant, and Policy Fellow at the Alliance for Innovation and Infrastructure

Kim O'Quinn, Corporate Vice President of Public and Community Relations at Mungo Homes

Michael Feazel, CEO of Roof Maxx

Kyle Shirley, Owner of Sol Vista Roofing

Wes True, General Manager and Operations at Pella Omaha

Clark Lowe, President and CEO at O’Connor Company

Key Findings:

The number of open positions remains high, with 306,000 jobs unfilled as of July 2025.

Construction labor shortages are driven by immigration policies, an aging workforce, and underinvestment in vocational education, creating structural challenges.

Wages vary widely by state, with Hawaii paying roughly 82% higher than what Alabama does.

Labor shortages are most acute in skilled construction trades such as carpentry, electrical, plumbing, and concrete specialists.

Industry leaders stress that retention, training, and cultural change are as critical as wages in attracting and keeping workers.

Labor scarcity is no longer a cyclical challenge; it’s a structural reality. Rising labor costs, longer schedules, and workforce gaps are squeezing margins and forcing differentiation.

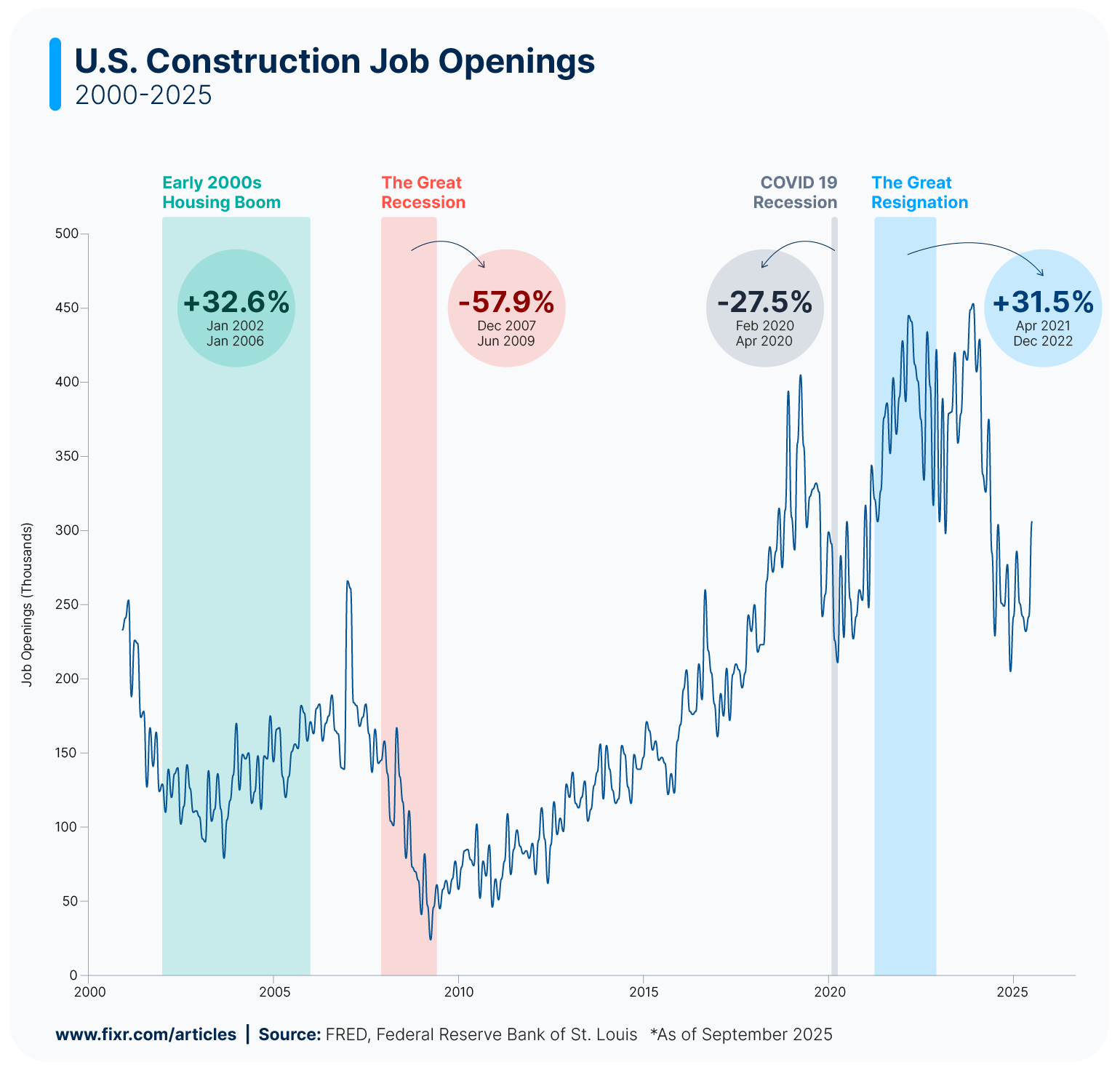

Construction Job Openings Timeline

The U.S. construction industry needed to attract about 439,000 new workers in 2025 to meet demand. In 2026, the forecast is that the number will rise to about 499,000 new workers.¹ As of July 2025, there are 306,000 job openings left unfilled.²

The U.S. construction industry needed to attract about 439,000 new workers in 2025 to meet demand. In 2026, the forecast is that the number will rise to about 499,000 new workers.¹ As of July 2025, there are 306,000 job openings left unfilled.²

Over the past 25 years, several major events have affected employment in the U.S., including in the construction industry:

Early 2000s Housing Boom (2002 - 2006): Rapid expansion in residential construction drove huge demand for labor. The industry needed to find enough labor to build 2 million homes a year to meet demand, and 45% of home builders reported a shortage of labor.³ There was a 32.6% increase in job openings from the beginning of 2002 to the beginning of 2006.

The Great Recession (Dec 2007 - Jun 2009): Total employment in the construction industry peaked in 2007, at 11.9 million, before falling to 9.1 million in 2010.⁴ There was a 57.9% decrease in job openings, primarily due to plummeting demand for new construction.

COVID-19 Pandemic (Feb 2020 - Apr 2020): The pandemic caused a 12.2% drop in construction employment between April 2020 and April 2021.⁵ Job openings fell by 27.5% from February to April due to reduced demand.

The Great Resignation (Apr 2021 - late 2022): The seasonally adjusted quit rate, which was 2.4% in January 2021 and only matched occasionally afterward, surged to 2.5% in March 2021, 2.8% in April 2021, and reached a record 3.0% in November 2021.⁶ Job openings increased 31.46% between April 2021 and December 2022.

Why Is There a Labor Shortage in the Construction Industry?

We’re seeing a major need for skilled trades across sectors—especially electricians, equipment operators, and concrete specialists. These roles are essential to delivery and increasingly hard to staff at scale.

Aaron Shavel

Civil Engineer, Infrastructure Consultant, and Policy Fellow

Alliance for Innovation and InfrastructureThe labor shortage continues to be one of the most pressing challenges for the construction industry in 2025. Across the country, construction companies are struggling to fill key positions critical to project delivery. “We are currently having the most difficulty filling skilled trades positions such as experienced door and window installers, carpenters and site supervisors,” says True. O'Quinn adds, “The roles we have trouble filling can vary by market. For instance, in Columbia, SC we are currently struggling with framers, electricians, plumbers, HVAC installers, and experienced trade middle management.” Feazel says “in my opinion and based on conversations with many counterparts in the construction industry – one of the hardest roles to fill right now is skilled labor – so framers, drywall installers, and finishing carpenters specifically.”

These are some of the reasons why the shortage persists:

Immigration Enforcement Policies

14.2% of the construction labor force is not U.S. citizens, leaving the industry especially vulnerable to immigration enforcement policies and visa restrictions.⁷ These policies can limit the availability of skilled labor, slowing down project timelines and increasing competition for qualified workers.

Aging Workforce

The average age of a construction worker in North America is 42. “Current projects are that 53% of the construction workforce is expected to retire in the next decade,” says Shavel. As experienced workers leave, fewer younger workers are entering the trades to replace them, creating a widening skills gap. O'Quinn shares her experience: “Across the ten markets served by Mungo Homes, the top reasons for labor shortages are an aging workforce with fewer young people entering the trades along with competition from other industries and commercial construction. True also thinks that “One reason for the shortages is demographics – large numbers of older construction workers are retiring and younger individuals do not seem as interested in becoming tradespeople, given an increasingly higher value placed on pursuing college degrees.”

Underinvestment in Vocational Education

As one of the causes of labor shortage, Shavel mentions “...underinvestment in vocational education and a cultural drift away from the trades.” He adds, “This is also coming at a time of unprecedented investment in public infrastructure, power and AI construction.” Feazel notes, “From my perspective, the growing shortage comes from lack of trade school promotion, stigma of working in the trades amongst youth, and increased demand across both residential and commercial builds.” This highlights how structural challenges in education and perception continue to limit the pipeline of skilled workers entering the industry.

Work Conditions

While demand for skilled workers continues to rise, many regions are struggling to attract and retain talent due to disparities in pay and the overall work environment. Shirley noted that in his market, “lack of severe weather in 2025, immigration enforcement, [and] wage imbalances” have all contributed to workforce shortages. True says that the “Rising housing costs and competition from other industries that offer steadier hours and benefits also make recruiting more difficult.” This highlights how both economic factors and local conditions play a role in the availability of labor, reinforcing the need for targeted strategies to improve recruitment and retention.

With demand rising faster than the available workforce, addressing these shortages will require coordinated efforts across policy, education, and industry to ensure the future of construction remains sustainable.

How Much Do Construction Workers Make per Year?

.png)

The map above shows the median construction worker wage by state. The median national wage for U.S. construction workers is $46,730, but it varies widely by location, with the highest-paying state offering about 82% more than the lowest-paying state. As of 2025, Hawaii ($66,100), Illinois ($64,890), and New Jersey ($63,190) top the list of highest-paying states, while Alabama ($36,300), Arkansas ($37,020) and Mississippi ($37,180) fall at the bottom.

These wage differences often reflect the cost of living, demand for workers, and regional labor shortages. For example, states experiencing high demand for new housing and construction projects are seeing upward pressure on wages, while regions with slower demand or labor surpluses remain lower on the scale.

Strategic Wage Planning for 2026

While our report highlights the wide variance in current construction wages, industry leaders are already thinking ahead to 2026. Data shows that simply raising pay isn’t a complete solution; instead, a strategic approach to compensation is needed to truly address the workforce issue. According to a report by CBIZ, construction leaders should plan for an average salary increase budget of 4.0% to keep pace with a competitive market. This proactive investment is aimed at reducing turnover, protecting valuable institutional knowledge, and mitigating the effects of pay compression. By prioritizing smart compensation planning, the industry is moving toward a more sustainable, long-term solution for its labor challenges.

Construction Professionals Reveal Ways to Attract and Retain Workers

To attract and retain workers, companies need to do much more than pay wages — regular hours, thorough training programs and clear career paths are just as important.

Shirley emphasized focusing on retention first: “We are focusing as much as possible on employee retention to avoid needing to rehire. When we must rehire, using sign-on bonuses has been effective for us.”

For Shavel, the issue is systemic: “Treat workforce development like infrastructure. Fund trade schools, expand apprenticeships, and make career paths visible and respected. We need to destigmatize vocational education and present it as a first-choice career path—not a fallback. A generation ago, these jobs built stable, middle-class lives, and they still can today.”

Feazel thinks that site culture and working conditions also matter deeply: “Offer better pay, training opportunities, and perhaps most important—stable scheduling. Culture also matters. A well-run site where workers feel respected goes a long way.”

O'Quinn highlighted the importance of tailoring strategies to local conditions. In Columbia, SC, Mungo Homes focuses on “competitive pay, consistent scheduling, safe and organized job sites, partnerships with trade schools, and building long-term relationships with our trade partners.” Meanwhile, “In Raleigh, attracting qualified workers hasn’t been the issue recently. The bigger challenge is retention.”

Building the Workforce of Tomorrow

Labor is the foundation of everything we do. To secure the future workforce, we need to keep investing in training, mentorship, and promoting construction careers.

The U.S. construction industry stands at a pivotal moment. Demand for housing, infrastructure, and energy projects is surging, but the workforce needed to deliver them is stretched thin. Addressing these shortages will require more than short-term fixes. It will take investment in workforce development, cultural shifts around trades careers, smarter immigration policy, and the adoption of technology that enhances productivity.

The future of depends not just on cranes, concrete, and code, but on people.

"Looking ahead, the winners will be those who treat workforce development like infrastructure—investing in training, career paths, and retention through clarity and culture. Companies that scale not by chasing bodies but by elevating capability and aligning purpose to execution will lock in competitive advantage in the decade to come," says Lowe.

FAQ

The construction labor shortage refers to the gap between the number of available skilled workers and the demand for construction projects. It affects roles across construction trades, including carpenters, electricians, and equipment operators, leading to project delays and increased labor costs.

Improving construction labor conditions involves offering competitive wages, stable scheduling, better training programs, and safe job sites. Investments in vocational education and career development can also help attract and retain workers in the construction trades.

The shortage is driven by an aging workforce, fewer young people entering construction trades, immigration restrictions, and underinvestment in vocational education. Regional disparities in pay and work conditions further exacerbate the problem.

Limited availability of skilled workers increases labor costs, delays project timelines, and can push up overall construction expenses. High-demand regions or specialized construction trades roles are particularly impacted.

The median annual wage for construction workers in the U.S. is $46,730 as of 2025, but pay varies widely by state and role. States like Hawaii, Illinois, and New Jersey offer the highest wages, while Alabama, Arkansas and Mississippi are at the lower end.

Methodology

For our first graphic, we gathered seasonally adjusted data on job openings in construction from the Federal Reserve Bank of St. Louis (FRED). We then analyzed key events over the past 25 years that influenced changes in construction job openings. Using the data from FRED, we calculated the percentage change in job openings for each event period to highlight trends and the impact of major economic and industry events on the construction labor market.

For our map, we gathered and analyzed data from the U.S. Bureau of Labor Statistics to examine construction labor wages across the country. We then compared the data across states to identify which states pay the highest and lowest wages in 2025.

Irena is an industry analyst and content specialist at Fixr.com, where she transforms complex data into clear insights that help readers make smarter financial decisions. She holds a degree in Economics and has been conducting personal finance research since 2018, bringing a strong analytical foundation to her work. Her insights have been featured in reputable outlets such as the Washington Examiner, Yahoo Finance, Fox40, and Forbes.