Updated: January 31, 2025

To provide you with the most accurate and up-to-date cost figures, we gather information from a variety of pricing databases, licensed contractors, and industry experts.

If you are buying a home, getting a home appraisal is a wise decision. The appraiser evaluates how much the house is worth based on comparable properties in the area and adds extra features that create value. Homebuyers use the appraisal to determine if the pricing on the house is fair and reasonable. Sellers often have an appraisal done to make certain they have the correct pricing for their home.

The average price for a home appraisal is $375 to $450, with the average homeowner spending around $400 for a single-family, 1,300 to 1,700 sq.ft. home with a few upgrades and small property. Homeowners can pay as low as $300 for a single-family 900 to 1,200 sq.ft. house with no upgrades, to as high as $1,200 for a single-family 1,800 to 4,000 sq.ft. house with many upgrades and land and a VA loan. Keep in mind that several factors increase the pricing, such as the size of the property, the number of home appraisers available, or if it is a high-end house where a “jumbo loan” is required.

Home Appraisal Fees

| House Appraisal Cost | |

| National average cost | $400 |

| Average range | $375-$450 |

| Low-end | $300 |

| High-end | $1,200 |

What Is a Home Appraisal?

A home appraisal is a process that lenders often require when a house is being used as collateral, which will act as security for the loan repayment. Refinancing, applying for a mortgage, or selling a house are common situations where you may need an appraisal. A licensed appraiser will conduct it to provide the bank with an accurate home value to ensure the collateral is sufficient. The appraiser inspects the home, noting the specifications, building materials, upgrades, and property. They also get comparison reports of similar homes sold in the last six months to give them insight into how the market views the value of that type of home. All their data and comps or comparable home sales will be compiled into a findings report which provides an estimated worth of the property to the lender and homeowner.

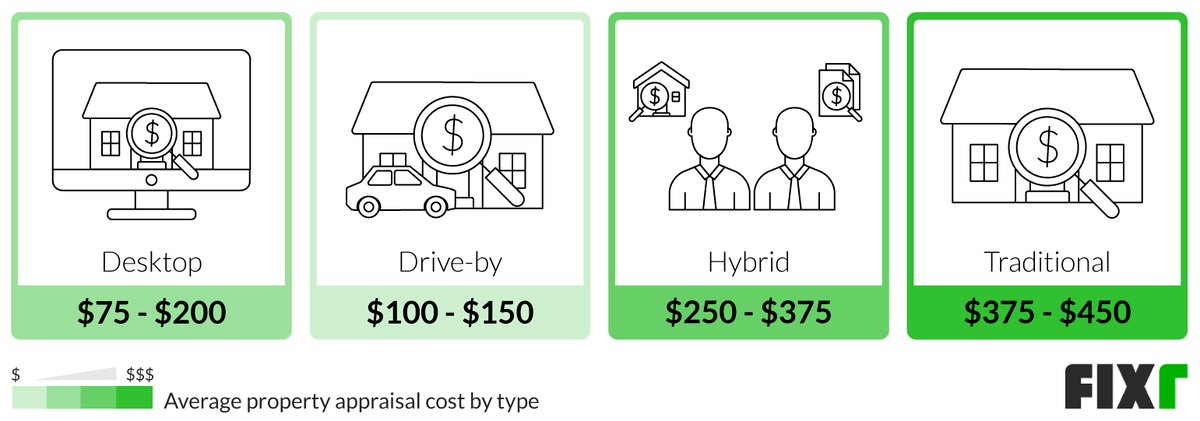

Property Appraisal Cost by Type

The overall cost of your appraisal depends on the type of appraisal being ordered. Different types will be used in different situations. The prices may be different. The type of evaluation chosen will be determined by the lender based on why they are having the house appraised. Below you will see the different appraisal options and the average prices you may expect to pay for each.

| Type | Average Cost |

| Desktop | $75 - $200 |

| Drive-By | $100 - $150 |

| Hybrid | $250 - $375 |

| Full | $375 - $450 |

Desktop Appraisal Fee

The least expensive option is a desktop appraisal which runs an average of $75 to $200. With a desktop evaluation, the appraiser researches your house and comps online to give you a written estimated value of your home. This type of valuation may or may not be acceptable to loan companies as an actual appraisal. Homeowners may use it to get an estimated value of their house before listing it. These will be most accurate if a home is in average condition because that will be the condition the appraiser assumes.

Drive-By Appraisal

A type of house appraisal that is becoming more used than before is a drive-by appraisal, which runs an average of $100 to $150. Drive-bys involve the appraiser viewing the exterior of the house and then drawing comps. They will not enter to perform an inspection. Mortgage companies will not typically allow these to secure a home mortgage. However, they may use them for other forms of lending, such as lines of credit or a refinance, if you have sufficient equity in your home. Other reasons for a drive-by valuation may be to get a basic valuation of a house in the foreclosure process.

Hybrid Home Appraisal

Hybrid home appraisals run an average of $250 to $375 and are increasing in popularity. They are most often used to ensure the house value covers the mortgage in a fluctuating market. It is not as often used in mortgage and refinance appraisals, but its efficiency is causing some lenders to allow it. A hybrid process uses two people for the assessment. A third party inspects the house and collects data on measurements, condition, and other features. They enter the house to do this. This data will then be given to the appraiser, who uses the information along with comp values to determine the appraised value without ever stepping foot in the house.

Traditional Home Appraisal

A full home appraisal costs from $375 to $450. This is by far the most common form of house evaluation still used and the one most often required when obtaining a mortgage for a home. With this type of process, there will be a complete onsite evaluation of the home, the property, and the neighborhood to draw an accurate price. Since this is the most accurate and time-consuming type of evaluation, it comes with a higher price tag. During the process, the appraiser collects data on the interior and exterior of the home, including the condition, and compares it with recent sales in the area to determine the value.

Average Cost of Home Appraisal by Type of Property

A property appraisal cost has several factors that contribute to the fee. The type of property you are buying impacts the cost. Many times, smaller properties equate to a lower price for the appraisal. Keep in mind that there are other components, but the size is a larger part of the fee.

| Type of Property | Average Cost |

| Land | $300 - $500 |

| Mobile Home | $300 - $775 |

| Modular Home | $375 - $450 |

| Condo | $375 - $450 |

| Single-Family Home | $375 - $450 |

| Multi-Family Home | $400 - $1,000 |

| Estate | $400 - $1,000 |

| Ranch/Farm | $1,000 - $3,000 |

Land Appraisal

Land appraisals are generally priced lower, with an average cost of between $300 to $500. There is less work to evaluate the property, and the process eliminates any building walkthrough. Much of what the appraiser needs to evaluate is done through research on surrounding properties. Other considerations the appraiser may make are features on the land, such as water supply.

Mobile Home Appraisal

The appraisal and inspection cost for a mobile home runs an average of $300 to $775. Mobile homes are also known as manufactured homes because they are built in a factory and then moved via truck to a lot or property. Since many people who have mobile homes also have land surrounding the home, the cost varies. Mobile homes will be appraised in a similar manner as single-family homes, though they are often less square footage, which can sometimes make the overall costs less.

Modular Home

An appraisal for a modular home costs from $375 to $450. They are very similar to single-family homes, except they are constructed differently, with partial construction of a modular home occurring at a factory and the finishing build being completed on-site. Modular homes run the same square footage as single-family homes and are often constructed on similar plots of land. The main difference between a single-family house evaluation and a modular home is that comps may be harder to find for modular homes depending on the area.

Condo Appraisal

You can expect to pay from $375 to $450 to have a condo appraised. It would seem that condo appraisal costs would be less expensive than a single-family home. However, that is typically not the case because condos have to have the entire building value accessed and then each condo individually. A condo also differs from a single-family house evaluation because there is often less land to include in the process. Since both of them take the same length of time, they tend to run in the same cost range.

Single-Family House

The average cost for a full evaluation of a single-family house is between $375 to $450. The total price you pay depends on the number of upgrades you have in your home, its size, and the amount of property surrounding it. A single-family house is meant to house one family only instead of a multi-family house which would be a duplex or condo. Most residential neighborhoods consist of single-family homes.

Multi-Family House

Appraisals for multi-family homes are much higher than others, running an average of $400 to $1,000. This is mainly due to the size being assessed and the multiple systems involved in the building. Multi-family homes are buildings that provide housing for two or more families. These would generally be townhomes or duplexes. During the process, each dwelling along with the overall building and property will be included in the assessment.

Estate Appraisal

Another more costly type is the appraisal of an estate. On average, you can expect to pay between $400 and $1,000, depending on the extent of the home’s contents. This is normally done after the death of the owner or in a divorce situation to assess the value of the house and its contents. The figure that is reached helps determine the taxes due on the property and how to divide the estate equitably.

Farm Appraisal

Ranches and farms are the most costly type of property to be appraised, running an average of $1,000 to $3,000. As these types of property consist of acres of land, the evaluation is typically more expensive. The pricing could also include the purchase of livestock and farm equipment. Other items that must be inspected and accessed include the house that sits on the land and any outbuildings such as barns and sheds.

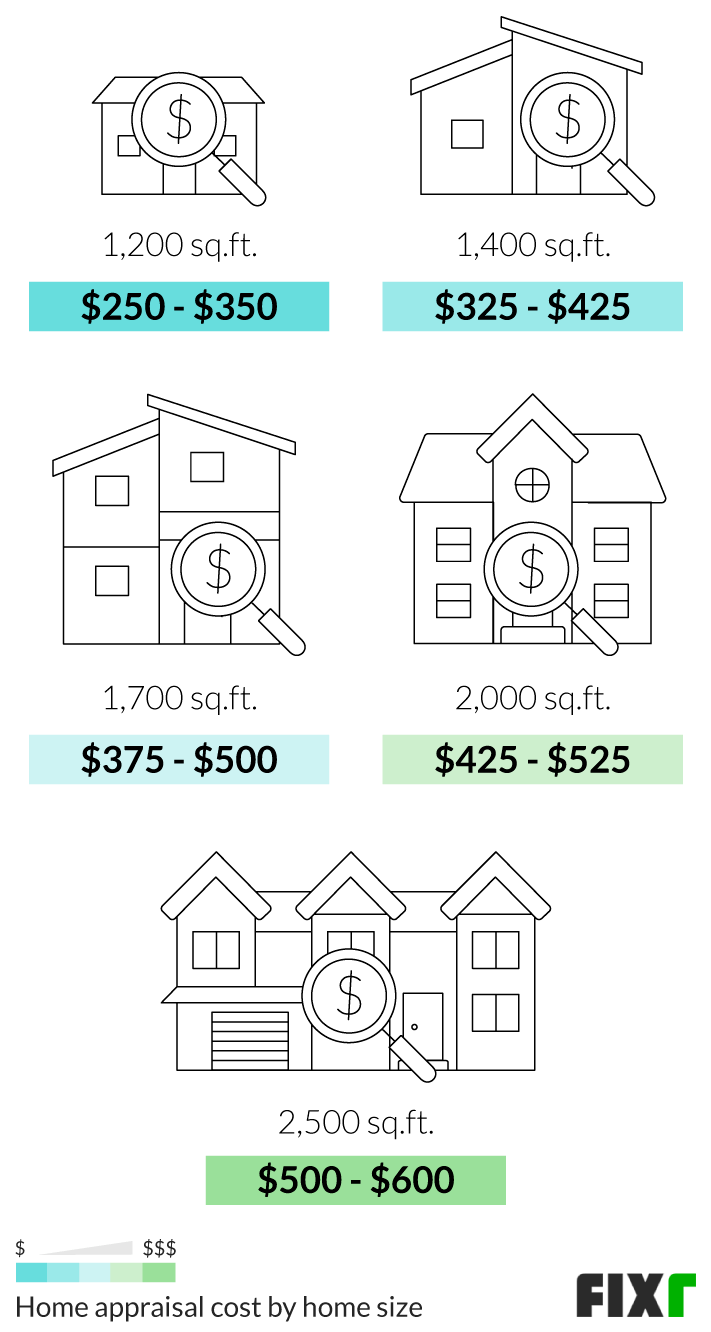

Home Appraisal Fees by House Size

These fees are often charged according to house size. It makes sense that if there is more square footage to appraise, the appraiser will charge more. They measure and consider any upgrades in each room. In addition, a larger house often has more expensive things such as granite, hardwood floors, marble tubs, and other amenities. These upgrades take more time to determine the value.

| House Size | Average Cost |

| 1,200 sq.ft. | $250 - $350 |

| 1,400 sq.ft. | $325 - $425 |

| 1,700 sq.ft. | $375 - $500 |

| 2,000 sq.ft. | $425 - $525 |

| 2,500 sq.ft. | $500 - $600 |

Property Appraisal Cost by Lender

A third-party impartial individual always conducts an appraisal. If the lender is ordering the evaluation, they choose who will perform it. Before the appraisal or any other money is spent, the lender provides the buyer with a loan estimate and closing disclosure so that all upfront and closing fees will be known ahead of time.

| Lender | Cost |

| Private | $375 - $450 |

| Bank | $375 - $450 |

| FHA | $400 - $700 |

| VA | $450 - $1,200 |

Private Appraisal

A private appraisal costs between $375 and $450. This type of evaluation is simply one that is done by the buyer or the seller, independent of the one ordered by the lender. This type can be completed by your choice of appraisers but be aware the lender may not use it. Often, a buyer or seller wants a second opinion on the value of the house and hires a private evaluation.

Bank Appraisal

The average cost for a bank appraisal is the same as for a private one, from $375 to $450. If you are financing your house through a bank, there will be a charge for a bank evaluation. This may be in your closing costs, or you may be required to pay prior to closing. These are done by a licensed appraiser, typically drawn from a list used frequently by the bank. The cost is generally based on size, type of property, and upgrades.

FHA Appraisal

As with other types of lending, an FHA inspection cost is around $400 to $700 and is priced according to size, type of property, location, and upgrades. FHA has its own separate checklist for approval. Basically, FHA wants to know that the house they are financing will be a safe and secure investment. For a house to be financed by FHA, it must meet the guidelines set by the Department of Housing and Urban Development, or HUD. While FHA does not set forth required pricing, it must see the costs as reasonable and customary for the housing market in that area.

VA Appraisal Fees

The average cost of an appraisal is pretty much the same across the board. However, VA evaluations are governed by the VA and cost from $450 to $1,200. Costs cannot rise above a certain level, which varies from state to state. The type of property also impacts the cost. For instance, in Florida, a single-family house evaluation cannot cost more than $500, and the report must be completed within seven days. In Montana, the cost cannot exceed $825, and the turnaround time is 14 days. To see your state’s information, check out this map for VA appraisals.

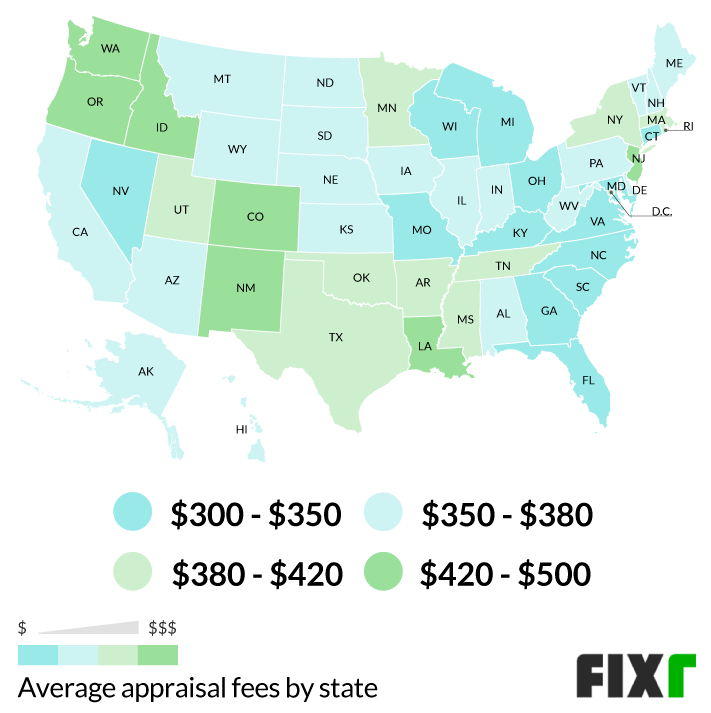

Appraisal Fees by State

The cost of house valuation varies from state to state because different areas of the country have different labor costs and may have different regulations and procedures. Areas in the Pacific Northwest and Southwest have higher fees than states in the Southeast and Midwest regions. Below you can see a map with the average cost you may spend on an appraisal based on your state. Please note that states are grouped in four price range categories in the map for convenience purposes. You will find more specific ranges for each state below the visualization.

| State | Average Cost |

| Alabama | $310 - $445 |

| Alaska | $325 - $430 |

| Arizona | $320 - $405 |

| Arkansas | $360 - $455 |

| California | $310 - $410 |

| Colorado | $350 - $505 |

| Connecticut | $310 - $385 |

| Delaware | $330 - $395 |

| Florida | $310 - $390 |

| Georgia | $300 - $375 |

| Hawaii | $325 - $430 |

| Idaho | $395 - $530 |

| Illinois | $325 - $415 |

| Indiana | $335 - $415 |

| Iowa | $325 - $420 |

| Kansas | $325 - $405 |

| Kentucky | $290 - $355 |

| Louisiana | $405 - $460 |

| Maine | $325 - $430 |

| Maryland | $305 - $390 |

| Massachusetts | $340 - $430 |

| Michigan | $280 - $330 |

| Minnesota | $350 - $460 |

| Mississippi | $360 - $405 |

| Missouri | $290 - $370 |

| Montana | $325 - $430 |

| Nebraska | $325 - $430 |

| Nevada | $310 - $380 |

| New Hampshire | $325 - $430 |

| New Jersey | $385 - $595 |

| New Mexico | $420 - $485 |

| New York | $330 - $435 |

| North Carolina | $295 - $390 |

| North Dakota | $325 - $430 |

| Ohio | $300 - $350 |

| Oklahoma | $380 - $460 |

| Oregon | $410 - $535 |

| Pennsylvania | $330 - $395 |

| Rhode Island | $380 - $435 |

| South Carolina | $245 - $370 |

| South Dakota | $325 - $430 |

| Tennessee | $380 - $455 |

| Texas | $340 - $445 |

| Utah | $340 - $435 |

| Vermont | $325 - $430 |

| Virginia | $310 - $375 |

| Washington | $410 - $590 |

| West Virginia | $325 - $430 |

| Wisconsin | $295 - $355 |

| Wyoming | $325 - $430 |

Why Do I Need an Appraisal?

There are many different purposes for having a house appraised. Some homeowners may want to have one before buying or selling a house to get an idea of value. Others need an official one to secure a mortgage, refinance, or obtain another type of loan. In all these instances, homeowners pay the same amount for their appraisal. The cost will be based on the type they choose. Below you will see some of the most common reasons homeowners and buyers opt for this type of house evaluation.

Buying and Selling a House

Buyers and sellers may opt to have a private appraisal which could be a traditional full house or a newer option, such as a desktop, hybrid, or drive-by. These are often independent of a mortgage evaluation. A seller may wish to have one to properly value their home for sale, while buyers may want a preliminary inspection to see if the price is in line before they apply for financing.

Mortgage Appraisal Fee

A mortgage requires a full home appraisal, though more and more lenders allow hybrid options as long as it involves a licensed appraiser. Mortgage companies as lenders are focused on only lending an amount equal to the value of the house or less. Because this is key to running a profitable lending business, a mortgage company always requires one.

Home Appraisal Cost for Refinance

When applying to refinance your home, you may have to pay for a full home appraisal. In cases where you have significantly more equity in your house than requested in the refinancing, the mortgage company may allow you to go with a less expensive drive-by option. For a refinance, the mortgage company often requires a new one for the same reasons as a new purchase, ensuring the housr is worth the same or more than they are lending you.

What to Do Before a Home Appraisal?

The value of your home will be directly influenced by how it looks. Here are some things to do before the appraiser comes:

Make sure your appraiser knows the neighborhood. Your appraiser must understand your neighborhood. The final pricing they determine is related to comparable homes in your area. Do some research of your own and find similar properties. Those properties near you make certain your appraiser has all they need to do a fair analysis.

Make any necessary renovations or upgrades. Renovations and upgrades are often deciding factors in pricing. If another house just like yours has been updated while yours has not, yours will be valued at a lower price.

Keep proof of all the renovations you have made to show the value of the changes. Potential buyers may also want proof of work done that is not visible. If you are ready to sell, don’t start any new renovation projects because this makes your home dusty and disorganized. Finish any existing projects before starting the selling process.

You will also want to make sure that your safety systems function properly. Perform tests on your alarms and make sure that your smoke detectors and carbon monoxide detectors have working batteries. Another issue that should be addressed is any possible infestations. If you have had a problem with insects or other pests, be sure to have these issues resolved before the date of your evaluation.

Pets can have a big impact on a home's value when it comes time to sell. They can cause damage to floors, baseboards, and especially the yard. When the damage is significant, a home will often appraise at 2-5% less than a pet-free home. Pet odor and scratched up woodwork sends a bad message to appraisers. When appraisers see those signs, they'll often pay more attention to the small details to make sure there isn't more significant damage. If you want to get the highest appraisal possible on your home, it's best to clean up any messes and fix any damage ahead of time.

What Does a Home Appraisal Include?

As a seller, you want to know the value of your home to make certain you get top dollar when you put it on the market. As a buyer, you want to make certain the house you are buying is worth the same or more than what you are paying. This type of process clarifies both of these situations. In addition, the lender usually requires a house appraisal to ascertain that the house is worth the asking price.

Appraisal Report

Your report includes a full description of the property. This notes the condition of the home and property, neighborhood growth and value, obvious repairs needed, the names on the title, the overall square footage, and the size of each room. Any upgrades or improvements will be added to the value. Also included will be market information based on surrounding areas. Other information would include proximity to lakes, rivers, easements or encroachments, zoning classifications, and utility services available. The typical cost for this type of report is $375 to $450, which is already included in the overall appraisal fee.

Appraisal Final Inspection Fee

Final inspections are usually necessary for new builds and remodels. After building a new home, the buyer or seller pays a final inspection fee of $150 to $175 to ensure that all work has been completed and is up to code. In situations where renovations are done with a reinspection to include completed projects in the house value portion, a buyer or seller may pay a reinspection fee of $150 to $175.

Home Appraisal Cost Factors

Although size might affect the cost, several other factors also impact it. These factors include:

- Type of property. Each type of property has a different amount of time and research needed, so it makes sense that costs vary.

- Type of loan. A jumbo loan is needed for a house that costs more than $510,400 in most areas. The evaluations for these types of purchases are more heavily scrutinized. The cost for a jumbo loan evaluation can be as much as $1,000. Some mortgage companies require a second opinion to compare the results.

- Urban or rural setting. Urban settings are areas that have a more dense population. This type is priced at $375 to $450. A more rural setting requires more research because the appraiser needs to appraise the home and the land, resulting in a cost of $600 to $800.

- Availability of appraisers. As with any supply and demand situation, a shortage of appraisers in your area could increase the cost of your appraisal. It could cost $100 to $200 more.

- Upgrades. A house with upgrades requires a little more work. While upgrades typically have a generally accepted price point, the more upgrades, the more time it will take to include those. If your house has several upgrades, you can expect to pay $100 to $200 more.

What Do Appraisers Look for?

During the process, your appraiser looks at many things throughout the interior and exterior of your home, neighborhood, and surrounding area to make a comprehensive report.

When looking at your home's exterior, they measure the total area of your property and note its condition. They check the primary outside structures, such as the roof, chimney, driveway, and pool, if there is one. They also look for aesthetic features, such as curb appeal and landscaping.

Once inside the home, the appraiser notes the square footage and the number and types of rooms. They will also check the integral systems to see that they are operating properly and their condition. This includes your HVAC system and appliances. They look for condition issues such as peeling paint, poor electrical or plumbing, and issues with structural integrity. Pest problems will be noted, and any noticeable house upgrades that add value.

Finally, they gather information about the neighborhood to compare and access the market value of the neighborhood. This involves looking at the recent sale price of homes in similar condition and of the same age and size to see what buyers are willing to pay for homes in that area.

Who Pays for the Home Appraisal?

This cost is a negotiable closing cost. If the seller is particularly anxious to sell, they may volunteer to pay this fee. On the other hand, if the buyer is very motivated, they may be the paying party. Certain states may have requirements for the amount or the category a buyer or seller is allowed to pay for in closing costs. Your real estate agent or mortgage company will be able to help you determine who should pay for this.

How Often Do Home Appraisals Come in Low?

If you are listing your home through a real estate agent, the price you have on the house is fairly on point. However, that is not always the case. You may get it lower than the purchase price. If this happens, the homeowner can write a letter and ask for an appeal. Keep in mind that this will only work if there is proof that the original appraisal was incorrect. An example would be if the appraiser did not realize you had put a new roof on the house or that your neighborhood had an amenity center with a pool. These situations are the stuff of nightmares for buyers and sellers alike. If you are desperate to sell and the report comes back lower than the offer, you can always offer to pay more closing costs.

How to Get the Highest Appraisal on Your Home?

Some factors would not negatively affect an appraisal but can leave a bad impression on an appraiser and cause a slightly lower evaluation. Remember that appraisers are people. While they follow a basic checklist, certain things may make them see your house in a favorable light.

One thing to take care of is clutter. Clutter makes it more difficult for them to do their job and gives the impression that it is not well cared for or that you are hiding issues beneath the clutter. Limit your knick-knacks and make sure that all clutter is put away. Another thing to focus on is the cleanliness of your home. A clean home that smells pleasant gives a better impression and a higher result. Odd odors and built-up dirt point to poor upkeep and maybe even some other concerns like recent pest infestations.

If you have neighbors whose yard or house looks unkempt, this also affects the result. Broken concrete, peeling paint, rotting boards, debris, and other signs of neglect bring a lower price point.

Adding fresh mulch, paint, cutting the yard, trimming bushes and edging the grass, pressure washing the sidewalk and driveway are all ways to add curb appeal to your home. Inside, do away with clutter, and clean up the dust. Clean or paint baseboards, straighten closets, cabinets, and remove items from bathroom/kitchen counters. Shampoo carpets, mop floors, clean the windows and doors, bathrooms, and kitchen area. Keep furniture to a minimum to make your house look larger.

How Long Does a Home Appraisal Take?

The home appraiser may take as little as 30 minutes or several hours to complete the inspection part of the process, depending on the size of the home, property, upgrades, and how accessible all of the areas of the house are. Then they do the research and calculations necessary to come up with an accurate analysis. It can take three to ten days to get it done.

Real Estate Appraisal Approaches

Although the outcome of the real estate appraisal is always to come up with a fair value, the approach used is often different based on the type of property. Whether comparing an existing home, a new home, or an income-producing property, the methods vary. Real estate agents and appraisers choose the right method for each situation.

Comparison Approach Appraisal

The Real Estate Sales Comparison Approach is used to compare apples to apples. In other words, they find homes just like yours within your neighborhood to compare recent sales. Once a comparison is made, any upgrades should be added to the value determined. The comparison approach helps to factor in a real estate market that is extremely high or low, as it will show what buyers are willing to pay for homes in the area.

Cost Approach Appraisal

The Real Estate Cost Approach method is used more effectively on new homes. The appraiser adds the value of the vacant property to the current cost of building the home. Depreciation will be subtracted. However, with a new home, there is no depreciation. This option should only be considered for newer homes where the cost of materials is fairly close to current costs, and the main home systems will not be outdated.

Income Approach Appraisal

The Income Approach Appraisal is generally used for income-producing properties, like rent houses. In this situation, an investor wants to consider any repairs or renovations that may need to be done. This is the best option when looking to rent out a property because the income you can generate could be considerably different than the cost would be if the home were to be sold to one owner.

Home Inspection vs Appraisal Cost

A home inspection is different from a home appraisal. While the appraiser is looking for items that add or take away value, the inspector is looking for problems. While some lenders require an inspection, others may not. Buyers should always have a home inspection done before buying a home, as there are no guarantees that the home is sound. The inspector looks for repairs that need to be done, such as HVAC systems problems, roof, plumbing, or electricity issues, leaks in windows and doors, structural and foundational issues, cracks, infestations, mold, mildew, appliances that will soon need replacing or are not in working order. Once the inspection is done, the buyer can approach the seller with a list of items to fix. The buyer has the option of performing the necessary tasks or losing the buyer. The cost for a home inspection is $300 to $500 versus the average cost of a home appraisal at $375 to $450.

| House Evaluation | Average Cost |

| Inspection | $300 - $500 |

| Appraisal | $375 - $450 |

Additional Considerations and Costs

- Qualifications. Appraisers must complete 79 hours of national coursework education provided by the Appraisers Qualification Board. In addition, the state in which the appraiser wants to work may have education requirements of its own. After completing this work, the student must work 1,000 hours under a licensed real property appraiser. Then, they must pass the Real Property Appraiser Exam and apply for a license.

- Change of circumstance. Generally, there is a 0% tolerance for increased appraisal fees due to a change of circumstance. The appraiser should stick to the original price stated. However, if new information is received that changes the cost of the evaluation, the appraiser has three days to disclose this to the lender and charge a higher price. This is called a change of circumstance. It could be such information as the home having more property or being larger than originally thought. In some instances, the increase is capped at 10%.

- Home layout. The house layout does not affect the cost of the evaluation. However, a more open floor plan is generally appraised higher than a chopped-up floor plan.

- Home age. While the age of your house doesn’t directly affect the cost, it could be more expensive if the home’s age creates more work for the appraiser. For instance, if the house is older, but others in the neighborhood are newer, the appraiser will have to do his research to find comparable values. This could increase the cost of the evaluation by $50 to $150.

- Other reasons. There are some cases where a house evaluation would be needed other than a mortgage. Any loan where your home is collateral, such as a house equity loan, would require one. Another reason you may need one is if you feel that your tax assessment is too high and wish to have the city consider a reduction.

- Appraiser credentials. Federal regulations require that an unbiased appraiser not chosen by the homeowner be used for an appraisal to be valid. Neither a lender nor the buyer can have a relationship with the appraiser to ensure that the valuation is unbiased and fair. Some homeowners may choose to select an appraiser to value their house when they plan to sell to decide on a listing price. However, this would be unofficial, and a new one will have to be completed for a mortgage.

FAQs

- Why did my house appraise so low?

There are several reasons why an appraisal may come back lower than the asking price. If you are sure your pricing is correct, you can appeal it if you feel the comparisons were inaccurate. This could be due to the appraiser missing such items as upgrades, renovations, or neighborhood amenities. You can also look at the sold home comparisons to make sure these are like homes sold recently.

- How to increase the appraised value of home for refinancing?

Obviously, upgrading or renovating increases the appraised value of your home when you are refinancing. Making sure the house is clean, well-organized, and free of clutter also helps. Repairing any major issues increases the appraised value as well.

- When is the appraisal done when buying a home?

It is one of the first tasks ordered when purchasing a home. Your lender will want to know immediately if the house is priced accurately to avoid spending time on a file that will not ever close.

- How much will my house appraise for?

Many online tools offer a somewhat accurate appraisal value on your home. Zillow is perhaps the most popular, but your real estate agent can help as well. Most real estate agents will do a free market analysis to give you a good idea of your home’s value.

- Why did the lender order a second appraisal?

There are three situations where the lender may order a second appraisal. If it has been three to six months since the original evaluation, the lender will order a second one to ensure no changes have occurred. This often happens when the home being purchased is a foreclosure home. The second reason is based on the type of loan the buyer is getting. Some loans require a second appraisal. Third, it could be that the seller is unhappy with the original evaluation and has requested a new one.

- How can I get a free home appraisal?

There are many online tools for this purpose. However, keep in mind that this is merely a snapshot for your own use. If you are purchasing or refinancing a home, a licensed appraiser will need to do the evaluation. The typical cost is $375 to $450.

- How long does an appraisal take once ordered?

The process can be as short as a few days to as long as two weeks from the day it is ordered to be completed. It will need to be scheduled, and the appraiser’s gathered data will need to be reviewed before a report can be completed.

- How long is a home appraisal good for?

In most cases, it will be good for 90 days. The number of days an appraisal is valid depends on the current real estate market and the type of loan. This is mainly because the comps or comparable home sales can change in a heavily fluctuating market.